Offshore Trust Strategies to Reduce Inheritance Tax Exposure

Offshore Trust Strategies to Reduce Inheritance Tax Exposure

Blog Article

The Duty of an Offshore Rely On Effective Estate Planning Methods

Offshore trust funds are significantly identified as a vital part of reliable estate preparation approaches. They offer unique advantages such as asset security, tax advantages, and enhanced personal privacy. By dividing possession from control, individuals can secure their riches from lawful challenges and possible financial institutions. The complexities surrounding offshore trust funds can elevate concerns about their execution and effectiveness - Offshore Trust. Checking out these complexities discloses insights that could meaningfully influence one's monetary legacy

Understanding Offshore Trusts: An Extensive Review

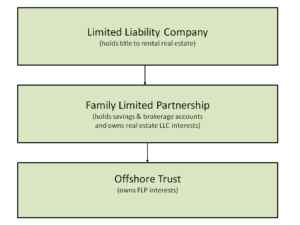

Offshore trusts offer as calculated monetary tools in estate planning, made to secure assets and provide tax obligation advantages. These trusts are developed in jurisdictions outside the settlor's home nation, often including beneficial lawful frameworks. Normally, people utilize offshore depend safeguard riches from political instability, economic slumps, or potential lawsuits.The core framework of an offshore depend on involves a settlor, who produces the trust fund; a trustee, in charge of handling the properties; and beneficiaries, who take advantage of the trust's possessions. This splitting up of ownership and control can improve asset protection, making it much more difficult for financial institutions to claim those assets.Additionally, offshore trust funds can facilitate estate preparation by making certain a smooth transfer of wide range across generations. They provide adaptability regarding asset monitoring and circulation, enabling the settlor to customize the count on according to individual wishes and household requirements. This customization is crucial for long-term monetary security and household legacy.

The Tax Advantages of Offshore Trusts

Offshore counts on provide significant tax advantages, primarily through tax deferral benefits that can enhance riches preservation. By tactically positioning possessions in jurisdictions with desirable tax obligation regulations, people can properly secure their wide range from higher taxation (Offshore Trust). Additionally, these trusts act as a durable asset security method, securing assets from lenders and lawful insurance claims while maximizing tax performance

Tax Deferment Advantages

Frequently neglected, the tax deferral advantages of trusts established in foreign territories can play a critical function in estate preparation. These counts on often permit people to defer tax obligations on earnings generated by the count on properties, which can bring about substantial boosts in wealth accumulation with time. By postponing tax liabilities, customers can reinvest revenues, improving their overall economic growth. In addition, the certain tax regulations of various offshore jurisdictions might offer possibilities for more tax obligation optimization. This tactical benefit enables people to align their estate planning objectives with long-lasting economic objectives. Inevitably, understanding and leveraging the tax obligation deferral advantages of overseas depends on can considerably enhance the performance of an estate strategy, guaranteeing that wealth is managed and made the most of for future generations.

Asset Defense Methods

Tax benefits are simply one facet of the advantages that offshore counts on can offer in estate planning. These trusts act as robust asset protection techniques, protecting possessions from prospective lenders and lawful cases. By transferring possessions into an offshore depend on, people can create a barrier that complicates creditors' access to those assets. This is particularly advantageous in jurisdictions with favorable trust legislations, supplying an extra layer of safety and security. Furthermore, overseas depends on can protect wealth against unforeseen situations, such as lawsuits or separation settlements. They also make it possible for people to maintain control over their properties while guaranteeing they are safeguarded from outside risks. Eventually, the critical use overseas trust funds can enhance both financial safety and estate preparation effectiveness.

Property Protection: Guarding Your Wealth

Privacy and Privacy in Financial Matters

In the domain of estate preparation, preserving privacy and discretion is a substantial worry for many individuals. Offshore trust funds act as an effective device to achieve these objectives, as they can efficiently shield economic events from public analysis. By placing possessions in an offshore count on, individuals can reduce the danger of unwanted direct exposure to their riches and economic strategies.The fundamental attributes of offshore depends on, such as rigid privacy laws and laws in particular jurisdictions, enhance discretion. This means that details relating to the count on's possessions and beneficiaries are commonly stayed out of public records, protecting delicate information.Moreover, the use of an overseas count on can assist reduce dangers related to prospective lawful disputes or creditor insurance claims, further advertising financial privacy. Generally, the strategic application of offshore trusts can considerably boost an individual's economic discretion, enabling them to manage their estate in a very discreet fashion.

Choosing the Right Territory for Your Offshore Trust fund

When thinking about the excellent jurisdiction for an overseas depend on, what aspects should be prioritized? The legal framework of the jurisdiction is essential. This consists of the count on regulations, asset defense statutes, and the general stability of the legal system. A jurisdiction with well-defined regulations can supply improved protection and enforceability of the trust.Another crucial consideration is tax obligation implications. Territories vary significantly in their tax treatment of overseas trusts, which can influence the overall performance of the estate preparation strategy. Furthermore, a favorable regulative setting that advertises personal privacy and privacy must be examined, as this is frequently an essential motivation for developing an overseas trust.Finally, ease of access and management needs are important. Jurisdictions with efficient processes and specialist solutions can promote easier management of the trust fund, ensuring that it fulfills the grantor's purposes and complies with conformity needs.

Usual Misconceptions Concerning Offshore Trusts

What are the prevalent misunderstandings surrounding offshore counts on? Several individuals mistakenly believe that offshore counts on are solely for the ultra-wealthy, assuming they are solely tools for tax evasion. In reality, offshore counts on can offer a varied variety of estate preparation requires, profiting individuals of various economic histories. An additional typical misunderstanding is that these depends on are underhanded Our site or illegal; nonetheless, when developed and handled appropriately, they follow worldwide legislations and laws. Furthermore, some individuals fear that offshore trusts do not have security from financial institutions, yet certain territories provide robust lawful safeguards. There is likewise a belief that handling an overseas depend on is excessively complex and pricey, which can hinder possible individuals. In reality, with appropriate guidance, developing and preserving an overseas depend on can be more uncomplicated than expected. Dealing with these false impressions is necessary for individuals taking into consideration offshore trusts as component of their estate planning method.

Actions to Developing an Offshore Depend On for Estate Planning

Developing an overseas depend on for estate preparation entails several critical steps. Individuals should pick a suitable territory that aligns with their legal and monetary objectives. Next, selecting the ideal trust possessions and drafting a detailed depend on file are necessary to ensure the count on operates properly.

Choosing the Jurisdiction

Selecting the ideal territory for an overseas trust fund is crucial, as it can significantly impact the depend on's effectiveness and the defenses it offers. Elements such as political stability, legal framework, and tax laws must be thoroughly reviewed. Territories recognized for solid asset protection regulations, like the Chef Islands or Nevis, are typically preferred. In addition, the convenience of keeping the trust fund and establishing is vital; some regions supply structured processes and less bureaucratic hurdles. Availability to neighborhood lawful expertise can also impact the choice. Ultimately, the chosen territory must line up with the grantor's details objectives, making sure maximum go to this web-site advantages while decreasing risks linked with administrative restrictions or regulatory adjustments.

Selecting Trust Properties

Choosing the appropriate properties to put in an offshore trust is a vital action in the estate preparation process. Individuals need to meticulously examine their assets, consisting of cash, financial investments, property, and service passions, to determine which appropriate for inclusion. This evaluation ought to think about aspects such as liquidity, prospective growth, and tax implications. Diversity of possessions can boost the count on's security and guarantee it meets the beneficiaries' requirements. In addition, it is necessary to account for any kind of legal restrictions or tax responsibilities that might occur from moving specific possessions to the overseas trust fund. Eventually, a well-balanced choice of trust possessions can greatly affect the performance of the estate plan and shield the customer's long for possession circulation.

Composing the Trust Fund File

Composing the depend on file is an essential action in the production of an overseas trust fund for estate preparation. This record outlines the specific terms under which the count on operates, outlining the duties of the trustee, recipients, and the circulation of properties. It is very important to plainly specify the objective of the trust fund and any stipulations that may use. Lawful requirements may vary by jurisdiction, so seeking advice from a lawyer experienced in overseas depends on is vital. The paper must likewise deal with tax implications and property defense approaches. Appropriately carried out, it not only safeguards assets but likewise ensures compliance with global regulations, eventually assisting in smoother estate transfers and lessening prospective disagreements amongst beneficiaries.

Often Asked Concerns

How Do Offshore Trusts Affect Probate Processes in My Home Country?

Offshore trust funds can considerably influence probate procedures by potentially bypassing regional administrative laws. They may safeguard assets from probate, reduce tax obligations, and improve the transfer of wealth, ultimately causing an extra reliable estate settlement.

Can I Be a Beneficiary of My Own Offshore Depend on?

The concern of whether one can be a beneficiary of their very own offshore trust fund commonly occurs. Usually, individuals can be named recipients, however details policies and effects may vary relying on jurisdiction and count on framework.

What Happens if I Relocate to One More Country After Developing an Offshore Count On?

If a specific moves to an additional country after establishing an overseas count on, they may deal with differing tax obligation ramifications and legal policies, possibly impacting the depend on's monitoring, distributions, and reporting commitments according to the new territory's laws.

Are Offshore Counts On Appropriate for Small Estates?

Offshore trust funds might not appropriate for tiny estates because of high arrangement and maintenance prices. They are typically a lot more advantageous for bigger assets, where tax advantages and property protection can warrant the expenses see post included.

What Are the Prices Connected With Keeping an Offshore Trust?

The costs linked with maintaining an overseas depend on usually consist of legal fees, management costs, tax obligation compliance, and prospective trustee charges. These prices can differ substantially based on the complexity and territory of the trust fund. Generally, individuals use offshore trusts to guard wealth from political instability, economic recessions, or prospective lawsuits.The core framework of an overseas trust includes a settlor, that develops the trust fund; a trustee, responsible for managing the assets; and beneficiaries, who benefit from the depend on's possessions. By putting wide range within an overseas count on, people can protect their possessions against lawsuits, divorce negotiations, and other unpredicted liabilities.Offshore trusts are normally regulated by the legislations of jurisdictions with positive property defense guidelines, offering enhanced safety and security compared to residential alternatives. By putting properties in an overseas depend on, individuals can minimize the threat of unwanted exposure to their wealth and economic strategies.The intrinsic functions of offshore trust funds, such as rigorous privacy legislations and regulations in certain territories, enhance confidentiality. Selecting the right jurisdiction for an overseas count on is crucial, as it can substantially impact the depend on's performance and the defenses it supplies. Drafting the trust fund file is an important action in the development of an offshore trust fund for estate planning.

Report this page